I’m here to tell you my story with Stock Market in India, the risk that I took, the reward that I got, where did I lose, and what all I gained in the last 10+ years. Investment in the stock market is not an easy game but yes, it’s risky and with risk, it gives reward too.

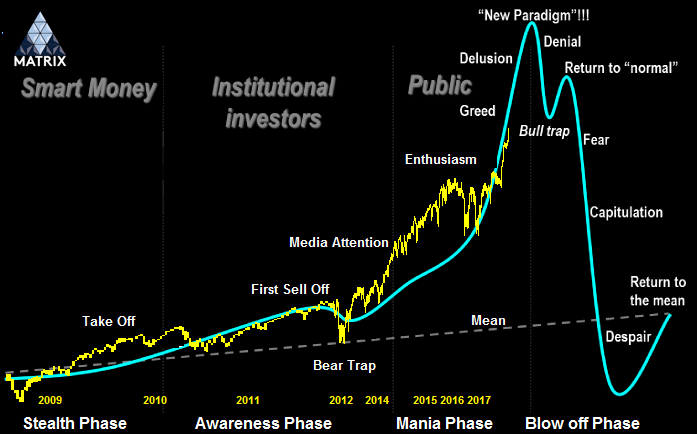

So, let me go back to 10 years back when I was working in IBM and it happened that I got an idea to save 10,000 INR of hard-earned income. I could have put that in a fixed deposit for 10 years and it would have been more than double by now. But I could see that craze for stock-based investment which was slightly risky and with the risk, there were chances of return. It is often said that the higher the risk you take, the more the chances of higher return. But this was not the end of the game, rather the start of the game, the stock market game. I was unaware of the fundamentals of financial statements, calculation of stock prices, EPS, PE, BV, and various financial ratios, I was blind. How can I invest my 10,000 INR in a company’s stock if I don’t understand the environment except that the stock price increases or decreases?

I took a nap and the next day I joined a small study course on the stock market – “Financial Market – A Beginner’s Module”. I went through the study materials all days and nights and completed my study in 10 days timeframe. Since all basic things about the stock market were clarified and to my self-pleasure, I also completed the certification from NSE’s NCFM, I was pretty happy and ready to put my 1st investment in stocks. But I was not happy from the inside, the NCFM course provoked me to complete little difficult modules too and ultimately I completed the “NSE Certified Market Professional – Level I” certificate too. The more I was getting into the world of finance, the more attractive it looked to me. I had already started my PG course on Finance, Master of Financial Analysis also called CFA from ICFAI. So, I was not in investment mode anymore, I was all in learning mode.

2-3 years later, when I completed all my finance learnings, I also landed to my dream job as a Business Analyst, and all my learnings which were once planned to make a serious investment in the stock market started paying dividends in jobs. But this is all about my initial journey as a trader or investor. I believe that trading and investment are two skills and one can be good at both or just one. And with practice and patience at times, one can master trading or investing more as an art than as a science.

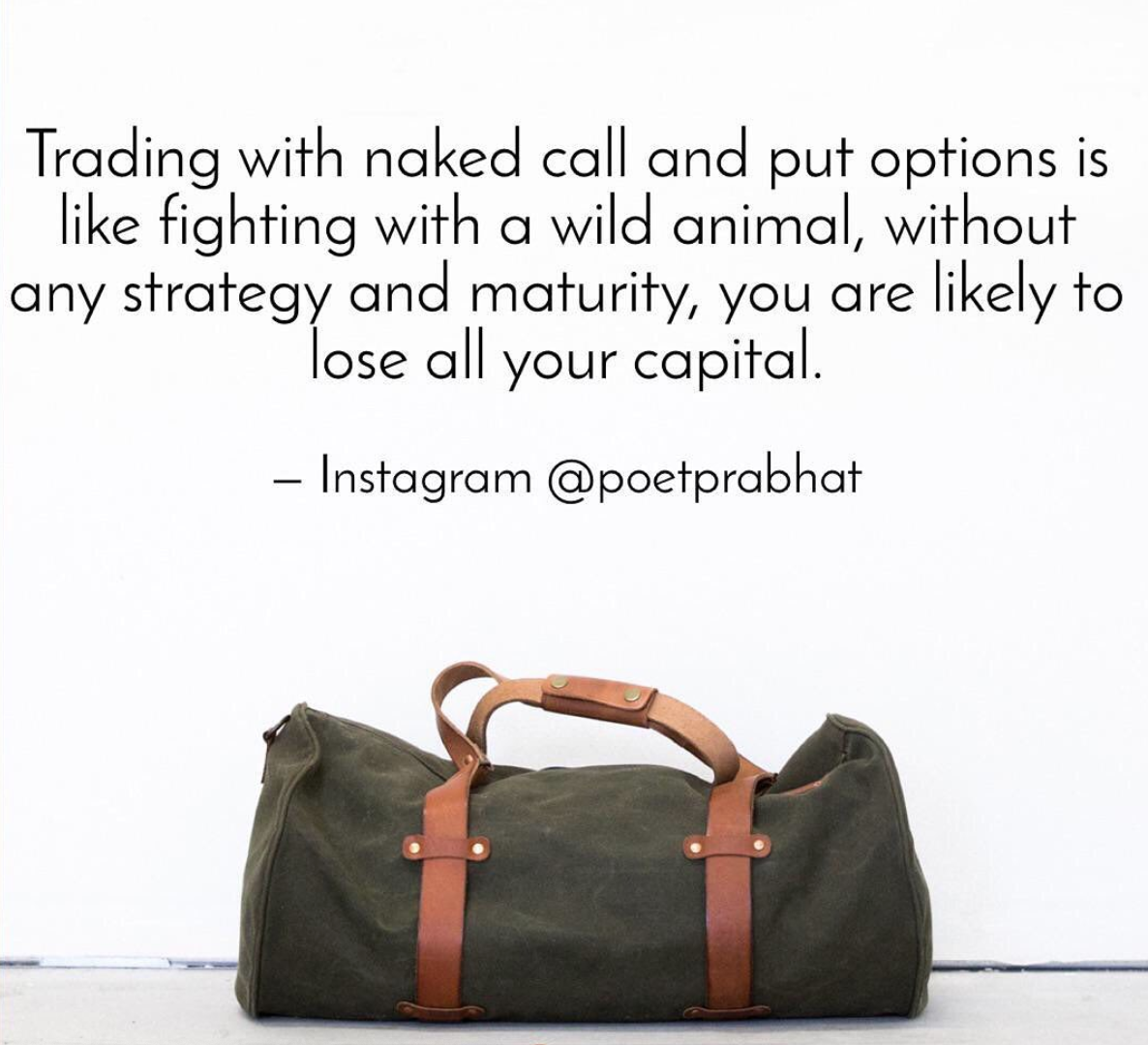

Once, I had a career break for one to two months and I decided to play on the riskiest asset of financial instruments. Actually, I took a call option on a 10k strike price when NIFTY was about to touch 10K for the first time. On the expiry date, it did not only touch 10k for the first time but also went 100+ points up in the intraday. To my surprise, a call option worth 2000 INR was trading in 14000 INR, it went 7 times high in intraday. Yes, this was my 1st speculation in the options market. Though finally, I realized much less profit as there was heavy sell on the last hours of the expiry day. But this triggered an idea in me, we can get our principal not only doubled but also get it 10 times within a matter of few days or just one day. So, this is not investment, nor it is trading, it is mere speculation on a lottery. If you are a wise investor, you will invest in options – put, call, and futures only for hedging and not for speculation. In fact, that event kept haunting me for the next few months and I spent more than 1l in speculation without any result. Let’s learn from this mistake and never ever invest in options on speculation. Refer to my quote below –

Further, the real benefit of the stock market lies in how you take it. First complete all the learnings, the bookish knowledge (NCFM/ CFA/ FRM texts), practical knowledge (from your stock market coach), Mind Mastering (learn to be patient, stick to fundamentals, stick to your own analysis and act timely). With all these, you will be very much confident while investing or trading in the stock market. My personal recommendation is to go for an analysis of few stocks based on sector and check their health and invest in them and keep reaping benefits after an interval, keep analyzing and screening new stocks every alternate day and monitor your portfolio on weekends to see if the new stock can get in and any old stock can be moved out.

The core of the analysis is that you should remain up to date with financial and geopolitical news, and focus on the sector which is likely to get momentum. Further to this, add technical analysis on 1h chart or 1d chart to predict any outbreak at the price. If trading in intraday trade mode, look out for downward move-related breakout too. With all these tips and techniques, I’m sure anybody can make handsome money with 10L capital as stock investments only.

I am still neither a trader nor a regular investor. But I do make some money from investing in stocks. If you liked my blog post and want more tips and tricks in financial markets, please get in touch with me. My email is connectprabhatkumar@gmail.com

Author: Prabhat Kumar